The City of Brillion will be performing a market revaluation in 2022

2022 Property Revaluation

The City of Brillion will be performing a market revaluation in 2022. The last time Brillion performed a revaluation of all property was in 2018, 4 years ago. Since then, the market has changed and assessed values no longer reflect the current market.

The state of Wisconsin is a Market Value state. This means property values are required to mirror the fair market value of comparable properties to ensure property owners are paying their fair share of taxes.

The fair market value of all property is calculated by reviewing arm’s length sales between a willing seller and a willing buyer on the open market. Assessors consider information from many sources to determine your assessment.

Assessors will be reviewing market sales up to January 1, 2022. Sales after the new year will not be used to determine your new value. The property tax bill you receive in December of 2022 will be based on the new assessment value of your property.

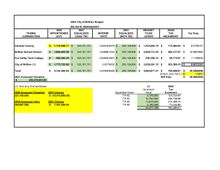

Assessors don’t set tax rates. The city does not collect new revenue based on an increase/decrease in your properties’ value. The revaluation does not change the amount of tax collected by the city, county, school district or technical college.

To learn more about what assessors do, please watch the video:

https://youtu.be/htGANg3eNqs

Timeline of Revaluation (To be determined):

Jan - March: Assessor reviews previous year’s sales and market data

March - April: Trespass letter will be sent to properties assessors need to visit

April - May: Permits and sales are verified

June - July: Comparable market data used to revalue all property

July - August: Notice of new value will be mailed to property owners

You will have a chance to speak with an assessor about your new value. You can call, email or visit the assessors website to set an appointment or talk live with an assessor at your convenience.

QUESTIONS

Accurate Assessor

www.accurateassessor.com

PO Box 415

Menasha WI 54952

Phone: 920-749-8098

The City of Brillion will be performing a market revaluation in 2022. The last time Brillion performed a revaluation of all property was in 2018, 4 years ago. Since then, the market has changed and assessed values no longer reflect the current market.

The state of Wisconsin is a Market Value state. This means property values are required to mirror the fair market value of comparable properties to ensure property owners are paying their fair share of taxes.

The fair market value of all property is calculated by reviewing arm’s length sales between a willing seller and a willing buyer on the open market. Assessors consider information from many sources to determine your assessment.

Assessors will be reviewing market sales up to January 1, 2022. Sales after the new year will not be used to determine your new value. The property tax bill you receive in December of 2022 will be based on the new assessment value of your property.

Assessors don’t set tax rates. The city does not collect new revenue based on an increase/decrease in your properties’ value. The revaluation does not change the amount of tax collected by the city, county, school district or technical college.

To learn more about what assessors do, please watch the video:

https://youtu.be/htGANg3eNqs

Timeline of Revaluation (To be determined):

Jan - March: Assessor reviews previous year’s sales and market data

March - April: Trespass letter will be sent to properties assessors need to visit

April - May: Permits and sales are verified

June - July: Comparable market data used to revalue all property

July - August: Notice of new value will be mailed to property owners

You will have a chance to speak with an assessor about your new value. You can call, email or visit the assessors website to set an appointment or talk live with an assessor at your convenience.

QUESTIONS

Accurate Assessor

www.accurateassessor.com

PO Box 415

Menasha WI 54952

Phone: 920-749-8098